Your personalized financial aid package will help you prepare for Indiana State and get ready to invest in your bright future.This page is designed to help decode your Financial Aid Notification (FAN) packet.

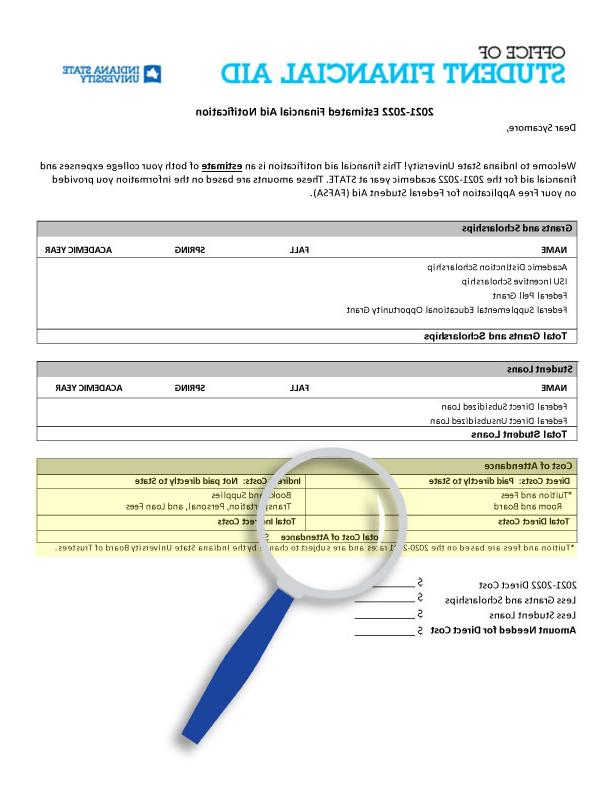

Grants and Scholarships

Financial aid that is awarded in the form of grants and scholarships is often referred to as Gift Aid. Gift aid may be based on merit or financial need. Gift aid doesn’t have to be repaid.

Grants: A form of “gift aid” that does not need to be repaid. Grants are awarded based on financial need calculated from information in your Free Application for Federal Student Aid (FAFSA).

Scholarships: A form of “gift aid” that does not need to be repaid. They’re typically awarded based on merit, such as academic performance, artistic talent, athletic abilities, or other criteria. If you receive outside scholarships (awarded by organizations other than ISU), inform the Office of Student Financial Aid with the Scholarship Notification Form.

Student Loans

Any source of money besides scholarships and grants, such as loans, is often referred to as Self Help Aid. Loans need to be repaid.

Federal Direct Subsidized Loan: A low-interest loan offered by the federal government to help cover your educational expenses. The Subsidized Loan is for undergraduate students with financial need, and interest begins to accrue AFTER graduation or when the enrollment status drops below half-time. Eligible students can accept the loan after July 1 in their MyISU Portal (assistance).

Federal Direct Unsubsidized Loan: A low-interest loans offered by the federal government to help cover your educational expenses. The Unsubsidized Loan is available to any student regardless of income, but interest begins accruing right after you receive the first loan disbursement during college. Eligible students can accept the loan after July 1 in their MyISU Portal (assistance).

Cost of Attendance

This is the estimated total cost of going to Indiana State University for one academic year, it is not a bill. It includes everything — tuition and fees, food and housing, books and supplies, and other college-related expenses. Your financial aid may cover a portion of the Cost of Attendance. Visit the MyISU Portal for an up to date breakdown of your cost of attendance on the Financial Resources tab > Account Summary.

Direct Costs: Expenses that are paid directly to Indiana State University. Items that will appear on your bill (Tuition, Student Recreation Center Fee, Health & Wellness Fee, On-Campus Food and Housing). Note: if you have notified ISU that you are living off campus the estimated Food and Housing amounts are indirect costs that will not be billed to you.

Indirect Costs: Expenses that are NOT paid to Indiana State University. These include items needed for daily living and recreational activities (Textbooks, Personal Expenses, Transportation Costs).

Amount Needed for Direct Cost

This shows if additional funding may be needed to cover your direct costs (billed amounts). Not to worry, check out the Additional Funding Options below or visit our Types of Aid page to see what else may be available. Note: if you have notified ISU that you are living off campus the estimated Food and Housing amounts are indirect costs that will not be billed to you.

Additional Funding Options

After reviewing the financial options if you still have not met your cost of attendance there are other sources of money available. Additional steps must be taken for these options and are listed on the Types of Aid page.

Federal Work Study: A part-time job, based on financial need. You must apply for a work study position on the Employment page.

Federal Direct Parent PLUS Loan: Available for undergraduate students that are considered to be dependent (dependency status). A loan taken by your parents to help cover your educational expenses. Their eligibility is subject to credit history and other criteria, and they are required to repay the loan — not you. If your parents apply but don’t qualify for the PLUS Loan, you could still apply for an additional Federal Direct Unsubsidized Loan.

Federal Direct Graduate PLUS Loan: Available for graduate/professional students, a loan taken to help cover your educational expenses. Your eligibility is subject to credit history and other criteria.

Private Alternative Loan: Loans offered by private lenders rather than the federal government. Interest rates and fees may vary based on your credit score.

Payment Options

Options for paying direct costs owed to Indiana State University.

A single payment plan means you pay for all charges for the semester (tuition and fees, food and housing) by the first day of the semester.

A monthly payment plan allows you to spread the academic year payments over 5 months (1 semester at a time), which requires enrollment in Nelnet Campus Commerce for a fee. For more information, contact Nelnet Campus Commerce at (800) 722-4867 or visit indstate.afford.com

A variable payment plan allows you to spread the amount and timing of payments in different ways, as determined by you, up to the final due date. Plan fees and due dates can be found at airllevant.com/payment-plans

Service Members

Military or National service benefits are available to help cover college expenses for service member and their families. Be sure to consult with the Indiana State University’s Veteran Services for additional funding opportunities at jw7s.airllevant.com/services/veterans.

Additional Information

There are many pieces to financial aid and it can often be a bit confusing. Be sure to check your University email and MyISU portal often for any additional information we may require.The Financial Aid Notification packet is only an estimate, on-campus housing cost are projected and subject to approval of the ISU Board of Trustees.To view your real-time award visit your portal at any time, information is always available!

Contact us with your questions!

Keep Up Your Progress

We want you to make steady headway toward earning your degree. Plus, your financial aid depends on it! To keep your awards, you must meet Indiana State’s Satisfactory Academic Progress (SAP) requirements – like a minimum cumulative GPA, course completion rate, and maximum total credit hours attempted. Talk with your academic advisor to make a degree plan that will lead you to the commencement stage within four years. For more information >>

Keeping your scholarship may require meeting specific academic standards, such as successfully completing 30 credit hours each academic year. Check the rules and regulations for your scholarships here.